Showing 1576–1584 of 1965 results

-

Don’t! The secret of self-control and Marshmallow experiment

$20.001. Read the following article:

Lehrer, J. (2009, May 18). Don’t! The secret of self-control. The New Yorker. Retrieved from: http://www.newyorker.com/reporting/2009/05/18/090518fa_fact_lehrer?currentPage=all

- Watch the following video: http://www.youtube.com/watch?v=7vObHeGF37U

This video is entitled “Marshmallow experiment”.

- Your reaction paper should contain a) a summary of the article and video, and b) a description of your personal reactions to the material. Papers should be approximately one and a half single-spaced pages in length, have one-inch margins, and use either the Calibri 12-point font or Times New Roman 12-point font (set for black ink). At least half of the paper should address your personal reactions to the assigned material. The content of the reaction paper is most important, but grammar/spelling errors will be penalized.

- Specifically, your reaction paper should:

- Have one section entitled “Summary” in which you provide a summary of the assigned materials. This section should be at least 1/2 page in length (single-spaced). Place an emphasis on summarizing the material in your own words. Use direct quotes only occasionally.

- Have one section entitled “Personal Reactions” in which you describe your personal reactions and opinions to the material (e.g., what you find to be important and/or significant about the material, areas of agreement and/or disagreement that you have with the material, ideas/thoughts that came to mind as you consider what was said, etc.). The “Personal Reactions” section of your paper should be at least as long as the “Summary” section, but should not exceed one page in length (single-spaced). Again, use direct quotes only occasionally.

5 Pages

-

Apple’s Corporate Audit

$60.00Contents (tables) of the paper include:

FIGURE 1: Porter’s value chain

FIGURE 2: Brand audit

FIGURE 3: Apple SWOT Analysis

FIGURE 4: Measuring Brand strength Interbrand

FIGURE 5: PESTLE Analysis for Apple and the Print Industry

FIGURE 6: Porter’s 5 Forces

FIGURE 7: Bownam’s Strategy Clock

FIGURE 8: Competitor Product Analysis

FIGURE 9: Competing e-book Product Features Analysis

Figure 10: Key advantages to digital vs print

FIGURE 11: Competitor Resource Analysis

FIGURE 12: Competitor Resource Diagram

FIGURE 13: Product portfolio analysisFIGURE 14: Product lifecycle

FIGURE 16: BCG Matrix

FIGURE 17: US Print & e-books sales ($b)

FIGURE 18: Market attractiveness

FIGURE 19: Sales per market; Growth per market territory

FIGURE 20: 12Cs Framework – Doole and Lowe – Print Industry

FIGURE 21: McKinsey’s 7

FIGURE 22: Shareholder value tube

FIGURE 23: Core competencies & Competitive Advantage

FIGURE 24: Financial Position -

Abbey Co. sold merchandise to Gomez Co.

$1.0021. Abbey Co. sold merchandise to Gomez Co. on account, $35,000, terms 2/15, net 45. The cost of the merchandise sold is $24,500. Abbey Co. issued a credit memo for $3,600 for merchandise returned that originally cost $1,700. Gomez Co. paid the invoice within the discount period. What is the amount of gross profit earned by Abbey Co. on the above transactions?

22.The following units of a particular item were available for sale during the year:

Beginning inventory 150 units @ $755

Sale 120 units @ $925

First purchase 400 units @ $785

Sale 200 units @ $925

Second purchase 300 units @ $805

Sale 290 units @ $925The firm uses the perpetual inventory system and there are 240 units of the item on hand at the end of the year. What is the total cost of ending inventory according to FIFO?

23.

a) The aging of Torme Designs shown below. Calculate the amount of each periodicity range that is deemed to be uncollectible.Est Uncollectible Accts

Age Interval: Balance: Percentage: Amount:

Not past due 850,000 3.50%

1~30 days past due: 47,500 5.00% 45,125

31~60 days past due: 21,750 10.00% 19,575

61~90 days past due: 11,250 20.00% 9,000

91~180 days past due: 5,065 30.00% 3,545.5

181~365 days past due: 2,500 50.00% 1,250

Over 365 days past due: 1,14595.00% 114.5

Total: 939,210b) If the Allowance for Doubtful Accounts has a credit balance of $1,135.00, record the adjusting entry for the bad debt expense for the year.

24. An employee earns $40 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 60 hours during the week, and that the gross pay prior to the current week totaled $58,000. Assume further that the social security tax rate was 7.0% (on earnings up to $100,000), the Medicare tax rate was 1.5%, and the federal income tax to be withheld was $614.

Required:

(1) Determine the gross pay for the week.

(2) Determine the net pay for the week.

-

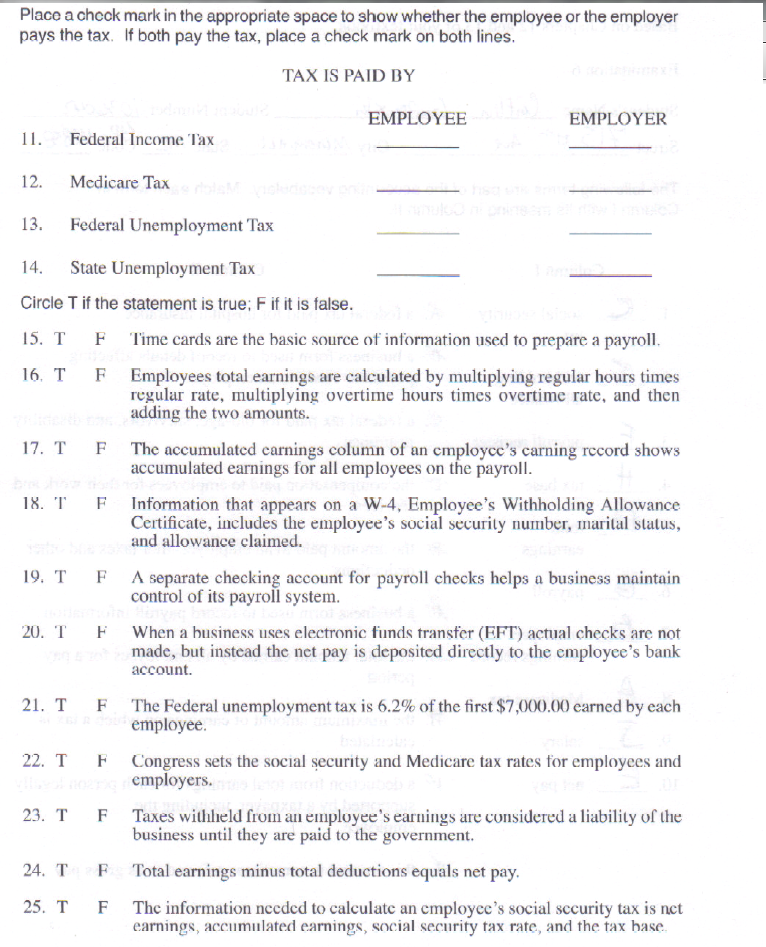

Place a check mark in the appropriate space to show whether the employee or the employer pays the tax

$5.00

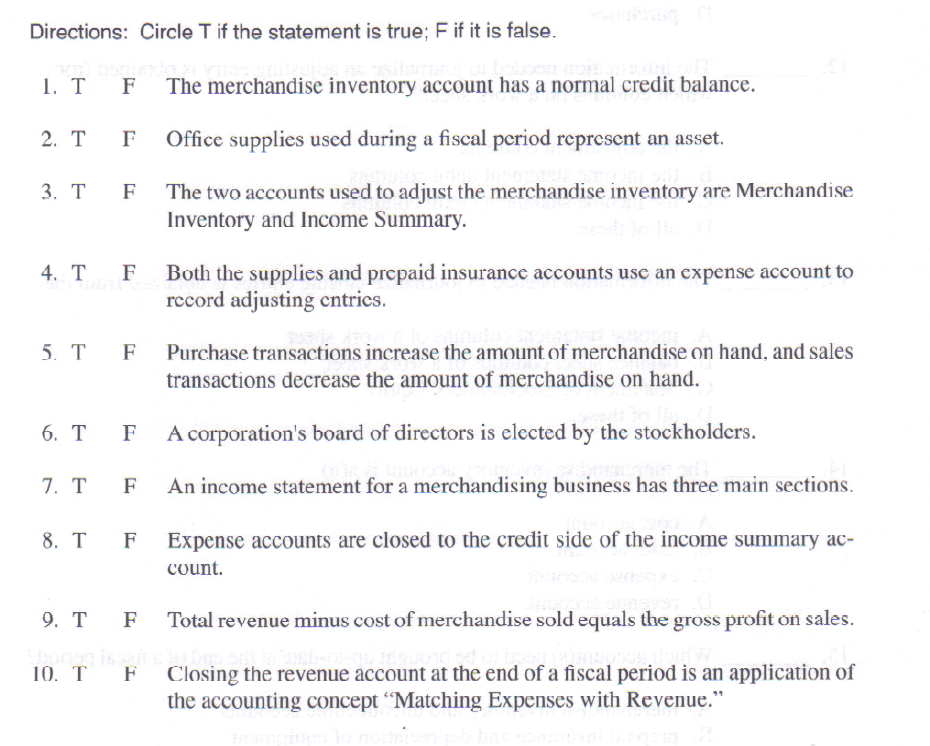

Text: Place a check mark in the appropriate space to show whether the employee or the employer pays the tax If both pay the tax, place a check mark on both lines. Circle T if the statement is true; F if it is False. T F Time cards are the basic source of information used to prepare a payroll. T F Employees total earnings are calculated by multiplying regular hours times regular rate, multiplying overtime hours times overtime rate, and then adding the two amounts. T F The accumulated earnings column of un employee’s earning record shows accumulated earnings for all employees on the payroll. T F Information that appears on a W-4, Employee’s Withholding Allowance Certificate, includes the employee’s social security number, marital status, and allowance claimed. T F A separate checking account for payroll checks helps a business maintain control of its payroll system. 1 F When a business uses electronic funds transfer (F.FT) actual checks arc not made, but instead the net pay is deposited directly to the employee’s bank account. T F The Federal unemployment tax is 6.2% of the first $7,(KH).(K) earned by each employee. T b Congress sets the social security and Medicare tax rates for employees and employers. T F Taxes withheld from ail employee’s earnings arc considered a liability of the business until they are paid to the government. T F Total earnings minus total deductions equals net pay. T F The information needed to calculate an employee’s social security tax is net earnings, accumulated earnings, social security tax rate, and the tax base. Directions: Circle T if the statement is true; F if it is false. T F The merchandise inventory account has a normal credit balance. T F Office supplies used during a fiscal period represent an asset. T F The two accounts used to adjust the merchandise inventory are Merchandise Inventory and Income Summary. T F Both the supplies and prepaid insurance accounts use an expense account to record adjusting entries. T F Purchase, transactions increase the amount of merchandise on hand, and sales transactions decrease the amount of merchandise on hand. T F A corporation’s board of directors is elected by the stockholders. T F An income statement for a merchandising business has three main sections. T F Expense accounts are closed to the credit side of the income summary account. T F Total revenue minus cost of merchandise sold equals the gross profit on sales. T F Closing the revenue account at the end of a fiscal period is an application of the accounting concept “Matching Expenses with Revenue.”

-

Insecure APIs and Interfaces on Apple

$37.50A Case Study Report Concerning Insecure APIs and Interfaces on Apple

Instructions:

IDENTIFY AND ANALYZE ONE CLOUD BREACHES OCCURRED IN 2012 OR AFTER

Paper Contents:

- A Cloud Threat Taxonomy.

- A Case Study – Apple iCloud Breach (2014)

- Description of insecure APIs and Interfaces

- A Data Breach

- Apple Macs Attack

- Report findings

- Remediation on Cloud Computing attacks

-

Time management: balancing your time and managing your schedule

$20.00An introductory paragraph with a thesis statement that addresses the purpose of the essay in Three to four body paragraphs that begin with topic sentences and clearly relate to and support the thesis statement as well as combine elements from the narrative and process prewriting paragraphs and a conclusion that reinforces the thesis statement and purpose of the essay.

Process Analysis: To illustrate your process for balancing your time and managing your schedule for the purpose of helping other distance education students learn how they can do the same

4 pages

-

Migrating to an Upgraded Network for a Customer Support Center

$15.00RESEARCH PROPOSAL: Migrating to an Upgraded Network for a Customer Support Center (Case of Nechleshah Company)

Paper Contents:

Brief Company background

Discussion of business problem(s)

High level solution

Benefits of solving the problem

Business/technical approach

Business process changes

Technology or business practices used to augment the solution

Conclusions and overall recommendations

High-level implementation plan

Summary of project3 Pages

APA 2 References

-

Program that calculates and outputs the monthly paycheck information for an employee

$5.00Write a program that calculates and outputs the monthly paycheck information for an employee, including all the amounts deducted from an employee’s gross pay, and the net pay that is due to the employee. The user of your program will know the employee’s name and the gross pay for the employee. Each employee has the following deductions taken from his gross pay:

Federal Income Tax: 15%

State Tax: 3.5%

Social Security + Medicare Tax: 8.5%

Health Insurance $75The output from your program should be structured as is displayed below:

Bill Robinson

Gross Amount: ………… $3575.00

Federal Tax: …………. $ 536.25

State Tax: …………… $ 125.13

Social Sec / Medicare: … $ 303.88

Health Insurance: …….. $ 75.00

Net Pay: …………….. $2534.75Your program should deal with erroneous input values. Gross salary should always be a positive number. Make sure that you deal with the possibility that the user may have entered a non-numeric input value. Have your program output appropriate error messages in these cases.

1. Identify the inputs and outputs of the problem.

2. Identify the processing needed to convert the inputs to the outputs.

3. Design an algorithm in pseudocode to solve the problem. Make sure to include steps to get each input and to report each output. Include steps to deal with error cases.

4. Identify three test cases, one using a positive number, and one using a negative number, and one using incorrect input (ie. Input a letter rather than a digit for the numeric input). For each of the three test cases show what inputs you will use and what your expected outputs should be.

5. Write the program to implement your algorithm. Test your program using your test cases. -

Calculate the take home pay for each employee for the week

$5.00

The payroll records of a company provided the following data for the weekly pay period ended December 7:

Employee Earnings to End of Previous Week Gross Pay Federal Income Taxes Medical Insurance Deduction Union Dues United Way Ronald Arthur $ 54,000 $1,200 $216 $125 $15 $15 John Baines 40,500 900 162 125 15 30 Ted Carter 45,000 1,000 180 150 -0- 20 The FICA Social Security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week’s wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

1. Calculate the take home pay for each employee for the week ended December 7th.

2. Prepare the journal entry to record the employee payroll expenses and liabilities.

3. Prepare the journal entry to record the employer payroll taxes expense.