Showing 541–549 of 728 results

-

Montana Timber Company Case Study

$2.00Text: Montana Timber Company is in the process of preparing its budget For next year. Cost of rods sold has been estimated at 70 percent of sales. Lumber purchases and payments are to be made during the month preceding the month of sale. Wages are estimated at 15 percent of sales and are paid during the month of sale. Other operating costs amounting to 10 percent of sales are to be paid in the month following the month of sale. Additionally, a monthly lease payment of $12,000 is paid to BMI for computer services. Sales revenue is forecast as follows:

prepare a schedule of cash disbursements for April may and June and totals for each month

-

Spirit Company, a merchandiser, recently completed…

$2.50Spirit Company, a merchandiser, recently completed its 2010 calendar year. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. The company’s balance sheet and income statement follow:

A. What is the net cash flows provided (used) by investing activities?

B. What is the amount of dividends declared and distributed in 2010?

C. What is the net cash flows provided (used) by financing activities?

D. Determine the cash received by Spirit for the equipment sold in item C above.(It might mean B but not sure)

-

Similarity and difference between the impact of induced demand and imperfect information

$2.008. Discuss the similarity and difference between the impact of induced demand and imperfect information on the amount of medical care a physician prescribes for a patient. Give at least one example of evidence from class on the existence of induced demand.

-

Using the birthwt data set…

$1.00Using the birthwt data set, find the point estimate and the 90% confidence interval estimation for the population mean of the number of physicians visits (Variable name: “ftv”) during the first trimester.

Please include all R code

data can be downloaded from here: http://bit.ly/HoxbZ2

-

After a successful first year, Cam and Anna decide…

$1.00After a successful first year, Cam and Anna decide to expand Front Row Entertainment’s operations by becoming a venue operator as well as a tour promoter. A venue operator contracts with promoters to rent| the venue (which can range from amphitheaters to indoor arenas to nightclubs) for specific events on specific dates. In addition to receiving revenue from renting the venue, venue operators also provide services such as concessions, parking, security, and ushering services. By vertically integrating their business, Cam and Anna can reduce the expense that they pay to rent venues. In addition, they will generate additional revenue by providing services to other tour promoters. After a little investigation, Cam and Anna locate a small venue operator that owns The Chicago Music House, a small indoor arena with a rich history in the music industry. The current owner has experienced severe health issues and has let the arena fall into a state of disrepair. However, he would like the arena to be preserved and its musical legacy to continue. After a short negotiation, on January 1, 2014, Front Row purchases the venue by paying $10,000 in cash and signing a 15-year 10% note for $380,000. In addition, Front Row purchases the right to use the “Chicago Music House” name for $25,000 cash. During the month of January 2014, Front Row incurred the following expenditures as they renovated the arena and prepared it for the first major event scheduled for February. Jan. 5 Paid $21,530 to repair damage to the roof of the arena. Jan. 10 Paid $45,720 to remodel the stage area. Jan. 21 Purchased concessions equipment (e.g., popcorn poppers, soda machines) for $12,350. Renovations were completed on January 28, and the first concert was held in the arena on February 1. The arena is expected to have a useful life of 30 years and a residual value of $35,000. The concessions equipment will have a useful life of 5 years and a residual value of $250. Required: Prepare the journal entries to record the acquisition of the arena, the concessions equipment, and the trademark. Prepare the journal entries to record the expenditures made in January. If no entry is required, leave answer boxes blank. Expenditures related to operating assets should be capitalized. Compute and record the depreciation for 2014 (11 months) on the arena (use the straight-line method) and on the concessions equipment (use the double-declining-balance method). Round all answers to the nearest dollar. Straight-line depreciation allocates the depreciable cost over the useful life of the asset. Double-declining balance is an accelerated method of depreciation in which depreciation expense equals twice the straight-line rate multiplied times the asset’s book value. See Cornerstones 7-2 and 7-3. Would amortization expense be recorded for the trademark? Why or why not? The input in the box below will not be graded, but may be reviewed and considered by your instructor.

-

The circular flow model

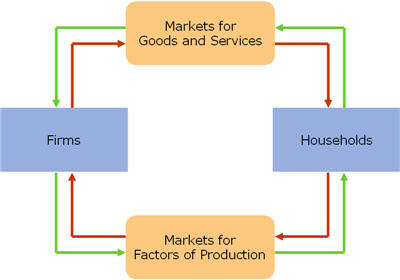

$1.001. The circular flow model

The following diagram presents a circular flow model of a simple economy. The outer set of arrows (shown in green) shows the flow of dollars, and the inner set of arrows (shown in red) shows the corresponding flow of inputs and outputs.

1.Based on this model, households earn income when (households/firms) purchase ( Goods and services/ Resource) in resource markets.

Suppose Megan earns $600 per week working as an analyst for A-Plus Accountants. She uses $8 to order a mojito cocktail at Little Havana. Little Havana pays Larry $350 per week to wait tables. Larry uses $225 to purchase tax services from A-Plus Accountants.

Identify whether each of the following events in this scenario occurs in the resource market or the product market.

Event Resource Market Product Market 2.Larry spends $225 to purchase tax services from A-Plus Accountants. (Resource mareket/ Product mareket) 3.Larry earns $350 per week working for Little Havana. (Resource mareket/ Product mareket) 4.Megan spends $8 to order a mojito cocktail. (Resource mareket/ Product mareket) 5.Which of the elements of this scenario represent a flow from a household to a firm? This could be a flow of dollars, inputs, or outputs. Check all that apply.

A.The mojito Megan receives

B.The $225 Larry spends to purchase tax services from A-Plus Accountants

C.The $350 per week Larry earns working for Little Havana

-

Master Landscaping Services Case Study

$2.50In August, Master Landscaping Services signed a contract to perform $6000 of landscaping services for a customer. The work was started and completed in September. The customer paid Master $3000 in September and $3000 in October. Master purchased $1000 of materials for the project in August, paying $500 at that time and $500 in September.

What are the revenues, expenses, and net incomes for all 3 months on the cash and accrual basis accounting types? If amount is zero, enter it as such.

-

Violations of the False Claims Act in private practice

$1.00You are the Compliance Officer of a 230-bed teaching hospital. You have just read a newspaper article reporting that a physician on the hospital’s medical staff has been charged with violations of the False Claims Act in his private practice. The charges include upcoming and billing for unnecessary services.

- Do you believe that there is any way that the hospital could be implicated in the physician’s misdeeds? What is your first reaction to receiving this information?

- If it appears that the charges are legitimate and some disciplinary action is necessary, what are your options?

- When you suggest suspending the physician form the medical staff for 6 months, the Chief Medical Officer reminds you that the physician refers a large number of patients to the hospital. Does this make a difference to you?

-

Convert all relations to third normal form

$1.0024. Figure 4-38 shows an EER diagram for a university dining service organization that provides dining services to a major university.

Convert all relations to third normal form, if necessary, and draw a revised relational schema.