Showing 532–540 of 728 results

-

Issues involved in resolving legal disputes in international transactions

$5.00Addressing International Legal and Ethical Issues Simulation Summary – Law 421 Week2 Assignment

- What are the issues involved in resolving legal disputes in international transactions?

- What are some practical considerations of taking legal action against a foreign business partner based in another country?

- What factors could work against CadMex’s decision to grant sublicensing agreements?

- When the local customs and laws conflict with the customs and laws of an organization operating abroad, which should prevail? Explain why.

- How would you compare the issues in this simulation to the domestic legal issues discussed in your Week One readings? How should companies resolve domestic and international issues differently?

-

Addressing International Legal and Ethical Issues Simulation Summary

$0.00What are the issues involved in resolving legal disputes in international transactions?

What are some practical considerations of taking legal action against a foreign business partner based in another country?

What factors could work against CadMex’s decision to grant sublicensing agreements?

When the local customs and laws conflict with the customs and laws of an organization operating abroad, which should prevail? Explain why.

How would you compare the issues in this simulation to the domestic legal issues discussed in your Week One readings? How should companies resolve domestic and international issues differently?

-

Greener Grass Company (GGC) competes with its main rival…

$5.00Greener Grass Company (GGC) competes with its main rival, Better Lawns and Gardens (BLG), in the supply and installation of in-ground lawn watering systems in the wealthy western suburbs of a major east-coast city. Last year, GGC’s price for the typical lawn system was $1,900 compared with BLG’s price of $2,100. GGC installed 9,960 systems, or about 60% of total sales and BLG installed the rest. (No doubt many additional systems were installed by do-it-yourself homeowners because the parts are readily available at hardware stores.)

GGC has substantial excess capacity it could easily install 25,000 systems annually, as it has all the necessary equipment and can easily hire and train installers. Accordingly, GGC is considering expansion into the eastern suburbs, where the homeowners are less wealthy. In past years, both GGC and BLG have installed several hundred systems in the eastern suburbs but generally their sales efforts are met with the response that the systems are too expensive. GGC has hired you to recommend a pricing strategy for both the western and eastern suburb markets for this coming season. You have estimated two distinct demand functions, as follows:

Qw =2100 6.25Pgw + 3Pbw + 2100Ag – 1500Ab + 0.2Yw

for the western market and

Qe = 36620 – 25Pge + 7Pbe + 1180Ag – 950Ab + 0.085Ye

for the eastern market, where Q refers to the number of units sold; P refers to price level; A refers to advertising budgets of the firms (in millions); Y refers to average disposable income levels of the potential customers; the subscripts w and e refer to the western and eastern markets, respectively; and the subscripts g and b refer to GGC and BLG, respectively. GGC expects to spend $1.5 million (use Ag = 1.5) on advertising this coming year and expects BLG to spend $1.2 million (use Ab = 1.2) on advertising. The average household disposable income is $60,000 in the western suburbs and $30,000 in the eastern suburbs. GGC does not expect BLG to change its price from last year because it has already distributed its glossy brochures (with the $2,100 price stated) in both suburbs, and its TV commercial has already been produced. GGC’s cost structure has been estimated as TVC = 750Q + 0.005Q2, where Q represents single lawn watering systems.

Show all of your calculations and processes. Describe your answer for each item below in complete sentences, whenever it is necessary.

- Derive the demand curves for GGC’s product in each market.

- Derive GGC’s marginal revenue (MR) and marginal cost (MC) curves in each market.

- Derive algebraically the quantities that should be produced and sold, and the prices that should be charged, in each market.

- Calculate the price elasticities of demand in each market and discuss these in relation to the prices to be charged in each market.

- Add a short note to GGC management outlining any reservations and qualifications you may have concerning your price recommendations.

-

Robert’s New Way Vacuum Cleaner Company…

$5.00Robert’s New Way Vacuum Cleaner Company is a newly started small business that produces vacuum cleaners and belongs to a monopolistically competitive market. Its demand curve for the product is expressed as Q = 5000 – 25P where Q is the number of vacuum cleaners per year and P is in dollars. Cost estimation processes have determined that the firm’s cost function is represented by TC = 1500 + 20Q + 0.02Q2.

Show all of your calculations and processes. Describe your answer for each question in complete sentences, whenever it is necessary.

- What are the profit-maximizing price and output levels? Explain them and calculate algebraically for equilibrium P (price) and Q (output). Then, plot the MC (marginal cost), D (demand), and MR (marginal revenue) curves graphically and illustrate the equilibrium point.

- How much economic profit do you expect that Robert’s company will make in the first year?

- Do you expect this economic profit level to continue in subsequent years? Why or

-

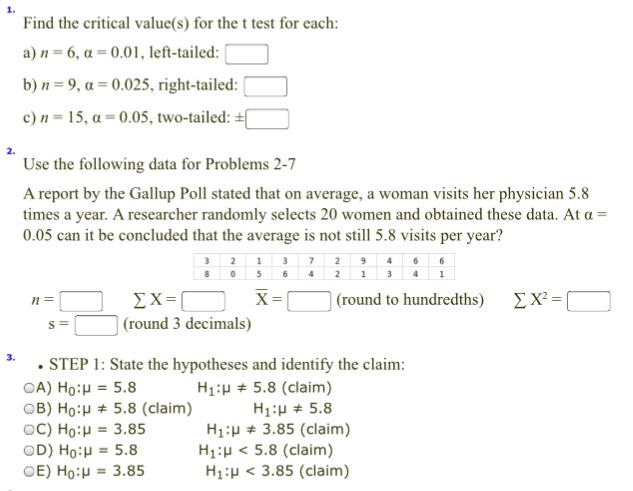

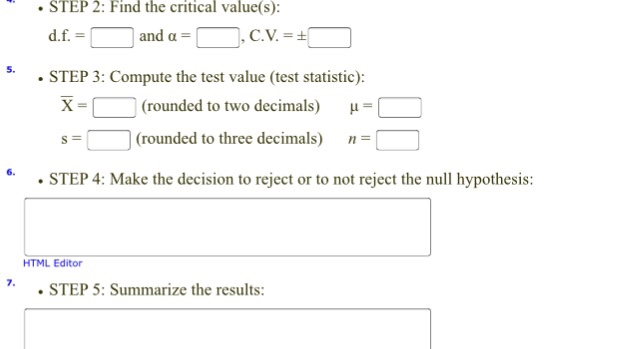

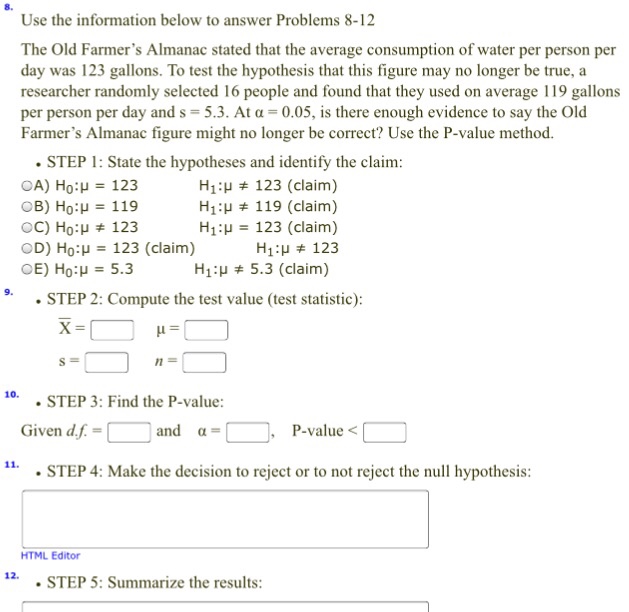

Find the critical value(s) for the t test for each

$5.00Find the critical value(s) for the t test for each: n = 6, alpha = 0.01, left-tailed: n = 9, alpha= 0.025, right-tailed: n = 15, alpha = 0.05, two-tailed: Use the following data for Problems 2-7 A report by the Gallup Poll stated that on average, a woman visits her physician 5.8 times a year. A researcher randomly selects 20 women and obtained these data. At alpha = 0.05 can it be concluded that the average is not still 5.8 visits per year? State the hypotheses and identify the claim Find the critical value(s): Computer the test value (test statistic): Make the decision to reject or to not reject the null hypothesis: summarize the results: Use the information below to answer Problems 8-12 The Old Farmer’s Almanac stated that the average consumption of water per person per day was 123 gallon. To test the hypothesis that this figure may no longer be rue, a researcher randomly selected 16 people and found that they used on ovarage 119 gallons per person per day and s = 5.3 At alpha = 0.05, is there enough evidence to say the Old Farmer’s Almanac figure might no longer be correct? Use the P-value method.

-

Zach Carey was a self-employed window…

$5.00Zach Carey was a self-employed window washer earning approximately $700 per week. One day, while cleaning windows on the 8th floor of the Second National Bank Building, he tripped and fell from the saffolding to the pavement below. He sustained severe multiple injuries but miraculously survived the accident. He was immediately rushed to the local hosptial for surgery. He remained there for 60 days of treatment, after which he was allowed to go home for futher recuperation. During is hospital stay, he incurred the following expenses: Surgeon: $2,500 Physician: $1,000 hosptial bill for room and board: $250 per day. nursing services: $1,200 anesthetics: $600 wheelchair rental: $100 ambulance: $150 drugs:$350 Zach has a major medical policy with Medical Benefits Corporation that has a $3,000 deductible clause, and 80% co-insurance clause, internal limits of $180 per day on hospital room and board, and $1,500 as a maximum sergical fee. The policy provides no disability income benefits.

1. Explain the policy provisions as they relate to deductibles, co-insurance- and internal limits.

2. How much should Zach recove from the insurance company? How much must he pay out of his own pocket?

3. Would any other policies have offered Zach additional protection? What about his inability to work while recovering from this injury?

4. Based on the information presented, how would you asses Zach’s health care insurance coverage? Explain.

-

Essay: Tranter, Inc., is considering a project

$10.00Essay

- Tranter, Inc., is considering a project that would have a ten-year life and would require a $1,500,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows:

All of the above items, except for depreciation, represent cash flows. The company’s required rate of return is 12%.

Required:

(a.) Compute the project’s net present value.

(b.) Compute the project’s payback period.

(c.) Compute the project’s simple rate of return.

- Five years ago, the City of Paranoya spent $30,000 to purchase a computerized radar system called W.A.S.T.E. (Watching Aliens Sent To Earth). Recently, a sales rep from W.A.S.T.E. Radar Company told the city manager about a new and improved radar system that can be purchased for $50,000. The rep also told the manager that the company would give the city $10,000 in trade on the old system. The new system will last 10 years. The old system will also last that long but only if a $4,000 upgrade is done in 5 years. The manager assembled the following information to use in the decision as to which system is more desirable:

Required:

(a.) What is the City of Paranoya’s net present value for the decision described above? Use the total cost approach.

(b.) Should the City of Paranoya purchase the new system or keep the old system?

- The following data concern an investment project:

The working capital will be released for use elsewhere at the conclusion of the project.

Required:

Compute the project’s net present value.

- Five years ago, Joe Sarver purchased 600 shares of 9%, $100 par value preferred stock for $75 per share. Sarver received dividends on the stock each year for five years, and finally sold the stock for $90 per share. Instead of purchasing the preferred stock, Sarver could have invested the funds in a money market certificate yielding a 16% rate of return.

Required:

Determine whether or not the preferred stock provided at least the 16% rate of return that could have been received on the money market certificate.

- Big Blue Co. is considering three investment opportunities having cash flows as described below:

Project I would require an immediate cash outlay of $10,000 and would result in cash savings of $3,000 each year for 8 years.

Project II would require cash outlays of $3,000 per year and would provide a cash inflow of $30,000 at the end of 8 years.

Project III would require a cash outlay of $10,000 now and would provide a cash inflow of $30,000 eight years from now.

Required:

If Big Blue has a required rate of return of 14%, determine which, if any, of the three projects is acceptable. Use the NPV method.

- Axillar Beauty Products Corporation is considering the production of a new conditioning shampoo which will require the purchase of new mixing machinery. The machinery will cost $375,000, is expected to have a useful life of 10 years, and is expected to have a salvage value of $50,000 at the end of 10 years. The machinery will also need a $35,000 overhaul at the end of year 6. A $40,000 increase in working capital will be needed for this investment project. The working capital will be released at the end of the 10 years. The new shampoo is expected to generate net cash inflows of $85,000 per year for each of the 10 years. Axillar’s discount rate is 16%.

Required:

(a.) What is the net present value of this investment opportunity?

(b.) Based on your answer to (a) above, should Axillar go ahead with the new conditioning shampoo?

- Lajara Inc. has provided the following data concerning a proposed investment project:

The company uses a discount rate of 13%.

Required:

Compute the net present value of the project.

- Burba Inc. is considering investing in a project that would require an initial investment of $200,000. The life of the project would be 8 years. The annual net cash inflows from the project would be $60,000. The salvage value of the assets at the end of the project would be $30,000. The company uses a discount rate of 17%.

Required:

Compute the net present value of the project.

- Grossett Corporation has provided the following data concerning a proposed investment project:

The company uses a discount rate of 10%. The working capital would be released at the end of the project.

Required:

Compute the net present value of the project.

- Woolfolk Corporation is considering investing $210,000 in a project. The life of the project would be 9 years. The project would require additional working capital of $46,000, which would be released for use elsewhere at the end of the project. The annual net cash inflows would be $42,000. The salvage value of the assets used in the project would be $32,000. The company uses a discount rate of 17%.

Required:

Compute the net present value of the project.

- Swaggerty Company is considering purchasing a machine that would cost $462,000 and have a useful life of 7 years. The machine would reduce cash operating costs by $115,500 per year. The machine would have no salvage value.

Required:

(a.) Compute the payback period for the machine.

(b.) Compute the simple rate of return for the machine.

- Alesi Company is considering purchasing a machine that would cost $243,600 and have a useful life of 8 years. The machine would reduce cash operating costs by $76,125 per year. The machine would have a salvage value of $60,900 at the end of the project.

Required:

(a.) Compute the payback period for the machine.

(b.) Compute the simple rate of return for the machine.

- Yeung Corporation is considering the purchase of a machine that would cost $330,000 and would last for 6 years. At the end of 6 years, the machine would have a salvage value of $33,000. The machine would reduce labor and other costs by $86,000 per year. The company requires a minimum pretax return of 12% on all investment projects.

Required:

Determine the net present value of the project. Show your work!

- The management of Glasco Corporation is considering the purchase of a machine that would cost $270,000, would last for 8 years, and would have no salvage value. The machine would reduce labor and other costs by $63,000 per year. The company requires a minimum pretax return of 18% on all investment projects.

Required:

Determine the net present value of the project. Show your work!

- Lovan, Inc., is considering the purchase of a machine that would cost $450,000 and would last for 8 years, at the end of which, the machine would have a salvage value of $63,000. The machine would reduce labor and other costs by $76,000 per year. Additional working capital of $3,000 would be needed immediately, all of which would be recovered at the end of 8 years. The company requires a minimum pretax return of 8% on all investment projects.

Required:

Determine the net present value of the project. Show your work!

- Dimpson Corporation is considering the following three investment projects:

Required:

Rank the investment projects using the profitability index. Show your work!

- The management of Grayer Corporation is considering the following three investment projects:

The only cash outflows are the initial investments in the projects.

Required:

Rank the investment projects using the profitability index. Show your work!

- Flamio Corporation is considering a project that would require an initial investment of $210,000 and would last for 6 years. The incremental annual revenues and expenses for each of the 6 years would be as follows:

At the end of the project, the scrap value of the project’s assets would be $24,000.

Required:

Determine the payback period of the project. Show your work!

- The management of Sobus Corporation is considering a project that would require an initial investment of $458,000 and would last for 9 years. The annual net operating income from the project would be $58,000, including depreciation of $48,000. At the end of the project, the scrap value of the project’s assets would be $26,000.

Required:

Determine the payback period of the project. Show your work!

- Shiffler Corporation is contemplating purchasing equipment that would increase sales revenues by $246,000 per year and cash operating expenses by $133,000 per year. The equipment would cost $275,000 and have a 5 year life with no salvage value. The annual depreciation would be $55,000.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent. Show your work!

- The management of Moya Corporation is investigating purchasing equipment that would cost $336,000 and have an 8 year life with no salvage value. The equipment would allow an expansion of capacity that would increase sales revenues by $288,000 per year and cash operating expenses by $164,000 per year.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent. Show your work!

- Hinck Corporation is investigating automating a process by purchasing a new machine for $520,000 that would have an 8 year useful life and no salvage value. By automating the process, the company would save $134,000 per year in cash operating costs. The company’s current equipment would be sold for scrap now, yielding $22,000. The annual depreciation on the new machine would be $65,000.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent. Show your work!

- The management of Kleppe Corporation is investigating automating a process by replacing old equipment by a new machine. The old equipment would be sold for scrap now for $19,000. The new machine would cost $180,000, would have a 9 year useful life, and would have no salvage value. By automating the process, the company would save $30,000 per year in cash operating costs.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent. Show your work!

-

Dr. Massy, who specializes in internal medicine…

$3.00Dr. Massy, who specializes in internal medicine, wants to analyze his sales mix to find out how the time of his physician assistant, Consuela Ortiz, can be used to generate the highest operating income.

Ortiz sees patients in Dr. Massy’s office, consults with patients over the telephone, and conducts one daily weight-loss support group attended by up to 50 patients. Statistics for the three services are as follows:

……………………………… Office Visits……………… Phone Calls………………. Weight-Loss Support Group

Maximum number

of patient billings per day……. 20……………………….. 40……………………………… 50

Hours per billing………………. 25………………………. .10 ……………………………….1.0

Billing rate……………………….. $50 ……………………..$25…………………………….. $10

Variable costs………………… $25………………………… $12……………………………… $5Ortiz works seven hours a day.

1. Dr. Massy believes the ranking is incorrect. He knows that the daily 60-minute meeting of the weight-loss support group has 50 patients and should continue to be offered. If the new ranking for the services is (1) weight-loss support group, (2) phone calls, and (3) office visits, how much time should Ortiz spend on each service in a day? What would be the total contribution margin generated by Ortiz, assuming the weight-loss support group has the maximum number of patient billings?

-

Exercise 3-8 Danielle Manning, D.D.S Assignment

$2.00Exercise 3-8 Danielle Manning, D.D.S., opened a dental practice on January 1, 2012. During the first month of operations, the following transactions occurred.

1. Performed services for patients who had dental plan insurance. At January 31, $820 of such services was earned but not yet recorded.

2. Utility expenses incurred but not paid prior to January 31 totaled $603.

3. Purchased dental equipment on January 1 for $84,000, paying $22,700 in cash and signing a $61,300, 3-year note payable.

(a) The equipment depreciates $420 per month.

(b) Interest is $613 per month.

4. Purchased a one-year malpractice insurance policy on January 1 for $25,020.

5. Purchased $1,662 of dental supplies. On January 31, determined that $377 of supplies were on hand.

Prepare the adjusting entries on January 31. Account titles are: Accumulated Depreciation❝Equipment, Depreciation Expense, Service Revenue, Accounts Receivable, Insurance Expense, Interest Expense, Interest Payable, Prepaid Insurance, Supplies, Supplies Expense, Utilities Expense and Accounts Payable.