Showing 1630–1638 of 1965 results

-

Give the follow Chart of Accounts and transactions…

$5.00Give the follow Chart of Accounts and transactions, prepare the general journal entries in the space provided below.

100 Cash

120 Accounts Receivable

130 Notes Receivable

140 Lawn Equipment

200 Accounts Payable

210 Notes Payable

220 Unearned Lawn Service Revenue

300 Capital, Art

400 Lawn Service Revenue

410 Interest Expense

420 Rent Expense1/1/A Art invested $15,000 in his business to provide Lawn Care Services creating a business checking account.

1/1 A Art purchased lawn care equipment for $8500, paying $4,00 cash and signing a one-year note to the bank for the remaining $4,500 to be paid in monthly installments.

1/1 /A Rented a storage are to store equipment, paying the monthly amount of $125.

1/12/A Art provided lawn care services to the local apartment complex, earning $22,150 and received cash for that amount.

1/15/A Art signed a contract for providing lawn care services to the local school district. He received a $1,000 check for providing the next 2 months of lawn service.

1/31/A Art paid the first payment on the note ($38.00 interest plus $375.00 principle repayment) -

For several years Arban, Inc…

$2.00For several years Arban, Inc., has followed a policy of paying a cash dividend of $0.47 per share and having a 5% stock dividend. In the 2011 annual report, Arban reported restated earnings per share for 2009 of $0.93. Required: (a) Calculate the originally reported earnings per share for 2009. (Do not round intermediate calculations and round your final answer to 2 decimal places. Omit the “$” sign in your response.) Earnings per share for 2009 $ (b) Calculate the restated cash dividend per share for 2009 reported in the 2011 annual report for comparative purposes. (Do not round intermediate calculations and round your final answer to 2 decimal places. Omit the “$” sign in your response.) Dividend per share for 2011 $ -

M3-19 Preparing an Income Statement [LO 3-1]

$2.00The following transactions are February 2013 activities of Swing Hard Incorporated, which offers golfing lessons in the northeastern United States.

a. Swing Hard collected $22,800 from customers for lesson services provided in February.

b. Swing Hard sold a gift card for golf lessons for $185 cash in February.

c. Swing Hard received $4,800 from credit sales made to customers in January.

d. Swing Hard collected $3,300 in advance payments for golf lessons to start in June.

e. Swing Hard billed a customer $210 for services provided between February 25 thru February 28. The bill is to be paid in March.

f. Swing Hard paid $6,600 for wages to its golf instructors for the month of February.

g. Swing Hard paid $3,400 for electricity used in the month of January.

h. Swing Hard received an electricity bill for $1,210 for the month of February, to be paid in March.

Prepare an income statement for Swing Hard Incorporated for the month ended February 28, 2013. (This income statement would be considered �preliminary� because it uses unadjusted balances.)

-

Monopolist under an average-cost pricing policy

$2.00

Text:

Consider the local telephone company, a natural monopoly. The following graph shows the demand curve for phone services, the company’s marginal revenue curve (labeled MR), its marginal cost curve (labeled MC), and its average total cost curve (labeled ATC). You can hover over the points on the graph to see their exact coordinates. Assume no government regulation. If the natural monopoly provides the profit-maximizing output, it will provide Suppose that the government forces the monopolist to set the price equal to marginal cost. In the short run, under a marginal-cost pricing regulation, the monopolist will provide phone services to at a price of If the government forces the natural monopoly to set its price equal to marginal cost, how will the company react in the long run? Because the firm earns a profit under marginal-cost pricing, it will remain in the industry in the long run. Because the firm suffers an economic loss under marginal-cost pricing, it will exit the industry in the long run. O Because the firm suffers an economic loss under marginal-cost pricing, it will reduce its output to 25,000 households per month in the long run.

Suppose that the government forces the natural monopoly to set its price equal to average cost. Under an average-cost pricing policy, the monopolist would provide phone services to price of I and earn a profit of per month. True or False: Under the average-cost pricing policy, the telephone company has no incentive to cut costs. -

Draw the average fixed cost, average variable cost, average total cost and marginal cost curve for a physician-firm

$20.001. Draw the average fixed cost, average variable cost, average total cost, and marginal cost curve for a physician-firm. Explain for each curve (4 explanations) why it has the shape that it does.

2. Assume the physician-firm is operating in a perfectly competitive market. Discuss and show graphically the firm’s output and price in the long-run.

-

How do companies manage the flow of products and services from production to the final consumer?

$1.00How do companies manage the flow of products and services from production to the final consumer? Explain with examples.

-

Mauer Company licenses customer-relationship software to Hedges Inc….

$0.00Mauer Company licenses customer-relationship software to Hedges Inc. for 3 years. In addition to providing the software, Mauer promises to provide consulting services over the life of the license to maintain operability within Hedges� computer system. The total transaction price is $200,000. Based on standalone values, Mauer estimates the consulting services have a value of $75,000 and the software license has a value of $125,000. Upon installation of the software on July 1, 2014, Hedges pays $100,000; the contract balance is due on December 31, 2014. Identify the performance obligations and the revenue in 2014, assuming (a) the performance obligations are interdependent and (b) the performance obligations are not interdependent.

(a) If interdependent, the contract is accounted for as a single revenue amount of $  .

.(b) If not interdependent, service revenue is $  and the license revenue is $

and the license revenue is $ .

. -

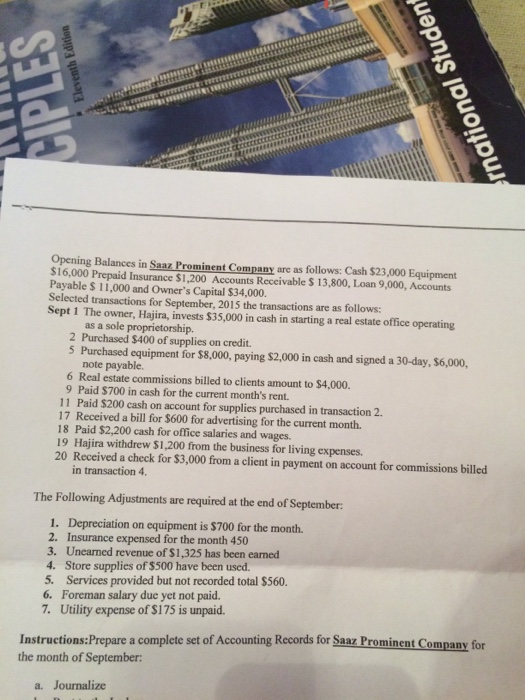

Saaz Prominent Company Case Study

$5.00Text: Cash $23,000 Equipment $16,000 Prepaid Insurance $1,200 Accounts Receivable $ 13,800,1-oan 9,000, Accounts Payable $ 11,000 and Owner’s Capital $34,000. Selected transactions for September. 2015 the transactions are as follows: The owner, Hajira, invests $35,000 in cash in starting a real estate office operating as a sole proprietorship. Purchased $400 of supplies on credit. Purchased equipment for $8,000, paying $2,000 in cash and signed a 30-day, $6,000, note payable. Real estate commissions billed to clients amount to $4,000. Paid $700 in cash for the current month’s rent. Paid $200 cash on account for supplies purchased in transaction 2. Received a bill for $600 for advertising for the current month. Paid $2,200 cash for office salaries and wages. Hajira withdrew $ 1.200 from the business for living expenses. Received a check for $3,000 from a client in payment on account for commissions billed in transaction 4. The Following Adjustments are required at the end of September: Depreciation on equipment is $700 for the month. Insurance expensed for the month 450 Unearned revenue of S1,325 has been earned Store supplies of $500 have been used. Services provided but not recorded total $560. Foreman salary due yet not paid. Utility expense of $175 is unpaid. Prepare a complete set of Accounting Records for Saaz Prominent C ompany for the month of September:

-

Tyler Financial Services Case

$5.00Tyler Financial Services performs bookkeeping and tax-reporting services to startup companies in the Oconomowoc area. On January 1, 2014, Tyler entered into a 3-year service contract with Walleye Tech. Walleye promises to pay $10,500 at the beginning of each year, which at contract inception is the standalone selling price for these services. At the end of the second year, the contract is modified and the fee for the third year of services is reduced to $9,800. In addition, Walleye agrees to pay an additional $20,600 at the beginning of the third year to cover the contract for 3 additional years (i.e., 4 years remain after the modification). The extended contract services are similar to those provided in the first 2 years of the contract.

1. Prepare the journal entries for Tyler in 2014 and 2015 related to this service contract. (If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Date Account Titles and Explanation Debit Credit Jan 1, 2014 Dec 31, 2014 Jan 1, 2015 Dec 31, 2015 2.

Prepare the journal entries for Tyler in 2016 related to the modified service contract, assuming a prospective approach. (If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Prepare the journal entries for Tyler in 2016 related to the modified service contract, assuming a prospective approach. (If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)Date Account Titles and Explanation Debit Credit Jan 1, 2016 Dec 31, 206 3.

Repeat the requirements for part (b), assuming Tyler and Walleye agree on a revised set of services (fewer bookkeeping services but more tax services) in the extended contract period and the modification results in a separate performance obligation. (If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Repeat the requirements for part (b), assuming Tyler and Walleye agree on a revised set of services (fewer bookkeeping services but more tax services) in the extended contract period and the modification results in a separate performance obligation. (If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)Date Account Titles and Explanation Debit Credit Jan 1, 2016 Dec 31, 2016